8 Reasons Why You Need Travel Insurance With Type 1 Diabetes & Where To Start

Getting Medical Travel Insurance With Type 1 Diabetes Or Pre-Existing Conditions

Travel medical insurance is a must for anyone traveling internationally, especially if you have a pre-existing condition like type 1 diabetes. Your regular health insurance is very unlikely to cover you outside your home country, and navigating a care system in a country you don’t even speak the language of can add stress to an already stressful situation.

Even if you don’t have a pre-existing condition, getting travel medical insurance is still a really smart decision. Medical emergencies can happen at any time—whether from an illness, an injury on cobblestone streets, or a mosquito bite that leads to malaria.

Unexpected accidents, like a hostel guest falling from a balcony while doing parkour (true story) can turn into costly medical situations.

The best part? Travel medical insurance is affordable compared to the potentially huge costs of emergency medical care without it. Plus, hospitals are more likely to provide quality, prioritized treatment when they know insurance will cover the bill.

Sign Up Now For New Travel Tips & Inspiration

This site participates in the Amazon Services LLC Associates Program and other affiliate programs and may earn from qualifying purchases.

DISCLAIMER: Always consult a healthcare professional before making any medical decisions. The information on this website should not be used as a substitute for professional medical care or advice. It provides general information and does not make any warranties about the completeness, reliability, or accuracy of this information. Type 1 diabetes travel will not be liable for any losses and/or damages in connection with the use of this website.

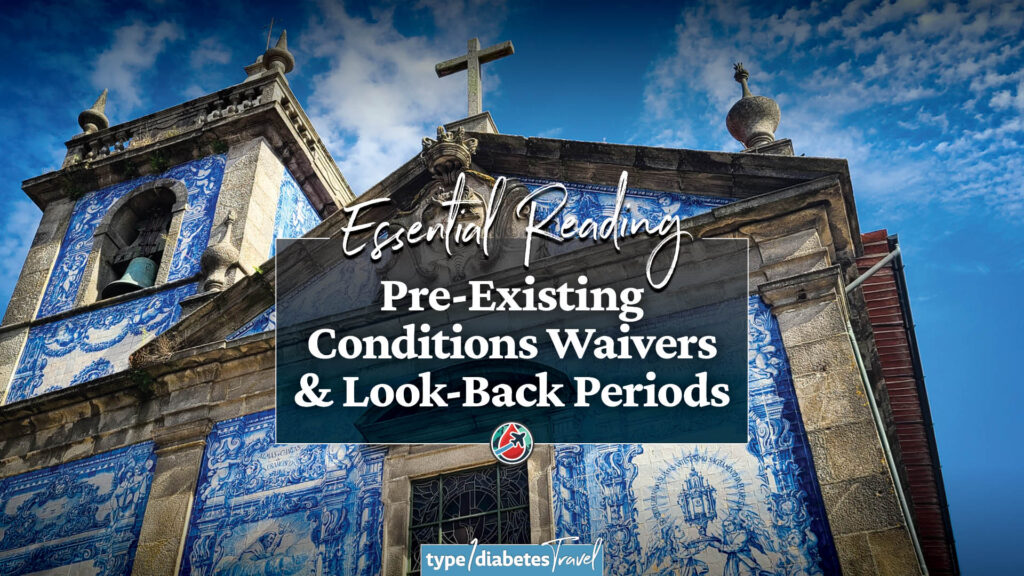

Does Travel Insurance Cover Pre-Existing Conditions?

Finding travel insurance with type 1 diabetes, heart disease, asthma, or many another pre-exiting conditions can definitely be tricky. Many policies don’t automatically cover pre-existing conditions, but some do if you meet certain requirements, like buying the plan within a set timeframe after booking your trip.

Always read the fine print and call the provider with questions before purchasing. The last thing you want is to assume you’re covered—only to find out you’re not.

Important Note!

Travel medical insurance is not the same as standard travel or trip insurance! Some standard travel policies include trip cancellation, lost baggage, or delays, but here we’re talking specifically about travel medical insurance coverage—which handles medical emergencies, hospital stays, and often (regional) evacuation.

8 Reasons Why You Need Travel Medical Insurance

1. Medical Emergencies Can Happen Anywhere

Even if you’re healthy, you can still get food poisoning, infections, dehydration, or simply injured while traveling. If you have type 1 diabetes, sudden illness can cause blood glucose level swings, leading to diabetic ketoacidosis (DKA) or severe hypoglycemia. Without travel insurance with type 1 diabetes, you could face high medical bills or even be denied care if you can’t pay upfront. And similar situations can arise with any major medical condition.

2. Your Regular Health Insurance Likely Won’t Cover You Abroad

Most health insurance plans don’t include international travel abroad or will only reimburse you much later—which won’t help if you need urgent care.

Some hospitals in international locations can require up to $1000 USD for a deposit before even admitting you to be seen!

A good travel medical insurance policy ensures you’re covered most places you can travel internationally. (Always check to see if any countries are excluded from coverage!)

3. Medical Evacuations Are Expensive

If you need an air ambulance to a better hospital, costs can range from $50,000 to $250,000 or more! A good travel medical plan **includes emergency evacuation to a better care facility if it’s deemed necessary, so you won’t get stuck with an impossible bill. Just keep in mind that most travel medical insurance policies don’t include evacuation to your home country. That’s called a standalone emergency evacuation policy.

Related Articles

4. Pre-Existing Conditions Can Flare Up

Managing diabetes while traveling can be unpredictable due to different foods, time zones, and activity levels. Travel insurance with type 1 diabetes is really helpful If you need emergency insulin, IV fluids, or hospital care, so you can focus on getting help.

5. Replacing Lost or Stolen Medications Is Hard

If your insulin overheats or a vail shatters, your pump breaks, or your supplies get stolen, finding replacements in another country can be difficult, expensive, or impossible without a prescription. Some policies cover emergency medication replacements. So even if you could purchase replacement insulin or flexpens for cheaper than in the U.S., it’s better to have that cost covered.

6. Peace of Mind for a Stress-Free Trip

Travel should be about exploring and enjoying—not stressing about medical bills. Travel medical insurance lets you relax, knowing you’re covered if something goes wrong.

7. Some Countries Require Travel Health Insurance

Certain destinations, like Schengen visa countries, Thailand, and parts of South America, may require proof of travel medical insurance before you can enter.

8. Company Representatives Can Guide You While Abroad

Many travel medical insurance providers offer in-app or phone assistance in finding local doctors, hospitals, and pharmacies. This can be especially helpful when traveling in a country where you don’t speak the language.

Travel Insurance With Type 1 Diabetes—5 Companies That Cover Pre-Existing Medical Conditions

Here are five travel medical insurance companies that offer travel insurance policies that cover pre-existing medical conditions like type 1 diabetes, type 2 diabetes, and more. This is just a short list, in alphabetical order, and is not an endorsement for any company. It’s just a place for you to start your search!

Allianz Global Assistance

Offers pre-existing condition coverage if purchased within 14 days of booking and you’re medically fit to travel at the time of purchase.

GeoBlue

Covers pre-existing conditions under the GeoBlue Voyager Choice plan. If you have a primary health plan at home, this policy will cover medical treatment for your condition while you’re abroad.

INF Visitor Care

Their Elite series covers pre-existing conditions, including diabetes, and is available for travelers up to 99 years old.

Total Travel Protection

Specializes in diabetes coverage with no age limits and includes emergency medical support and medication coverage.

Travelex Insurance Services

Covers existing conditions if you buy the policy within 21 days of booking and are medically fit to travel.

Key Things to Keep in Mind—Finding The Best Travel Insurance Policy For You

- Buy early – Most insurers require you to purchase insurance coverage within 14-21 days of booking your trip for pre-existing condition coverage.

- Fit for travel – You must be medically fit to travel when purchasing the plan, or sometimes at least be able to prove you were fit to travel by other means. This is typically regardless of whether you have a major medical condition, so if a company can prove you were sick or may have contracted a sickness prior to travel, your claim could be declined!

- Compare different companies and policies – Read different policy details to know exactly what’s covered and what’s excluded before you choose a provider and policy. And don’t be afraid to call the company and ask questions and for clarification before you purchase a policy!

Travel Smart, Stay Covered

Traveling with type 1 diabetes or any pre-existing condition doesn’t have to be more stressful. Travel insurance with type 1 diabetes coverage or pre-existing condition coverage, can protect you from unexpected medical bills, emergency evacuations, and prescription issues, letting you enjoy your trip with confidence.

Safe travels!

Sign Up Now For New Travel Tips & Inspiration

This site participates in the Amazon Services LLC Associates Program and other affiliate programs and may earn from qualifying purchases.

DISCLAIMER: Always consult a healthcare professional before making any medical decisions. The information on this website should not be used as a substitute for professional medical care or advice. It provides general information and does not make any warranties about the completeness, reliability, or accuracy of this information. Type 1 diabetes travel will not be liable for any losses and/or damages in connection with the use of this website.

I have been diabetic Type 2 since 2003 I was on Metformin 850mg at night and 60 units Actraphane. my symptoms were cold feet weather it was warm or cold my feet were always cold especially at night, I also had severe neausa from taking metformin so this year my family doctor decided I should try alternative treatment as Metformin caused severe side effects; I agreed and decided to start the Diabetes protocol offered at UineHealth Centre. my symptoms have greatly improved with no signs of blurred vision which I always seem to use to have or the frequent thirst. No more numbness of my feet I’m active again which has helped me loose weight. Since starting the diabetes formula my A1C is back to normal range and my blood sugars have stated normal. I’m surprised a lot of people with Diabetes T2 haven’t heard of the formula. Visit Uinehealth centre. com I got it from them.